Transport Weekly | Hasn’t adopted AI yet?

In recent years, with the rapid development of technology, new terms such as big data analysis, artificial intelligence and blockchain have been pouring into the eyes of everyone. It seems that every concept can solve current issues and help us move into a beautiful new world. Taking artificial intelligence as an example, with the scope of AI application becoming more and more extensive, this concept is more and more often mentioned and has even become one of the “Top Ten Chinese Media in 2017”.

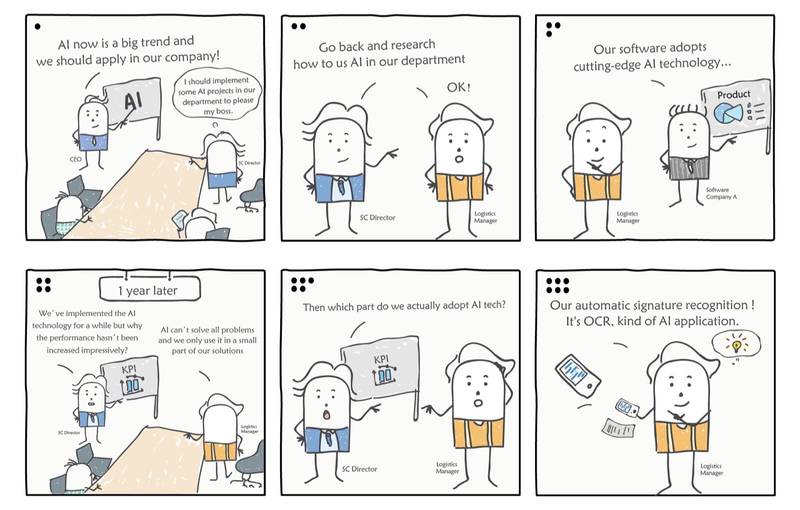

Many companies want to apply the latest technology to their management and operations, to ensure that the company does not fall behind. It’s the same for logistics industry. However, limited to the backwardness of informatization and digitalization in the logistics industry, new technologies such as artificial intelligence are often only used as a marketing tool. Suppliers may say they are using cutting-edge AI tech but in real word, the scope of application may still be limited to such small things as Optical Character Recognition (OCR).

Two key factors are required to truly achieve industry innovation through new technologies.

First, change manual operations to achieve supply chain digitization. Data is the basis for all innovation in the information age. If the data is still scattered and remains offline, there is no use talking about optimization through big data analysis and AI. Second, open attitude and unremitting efforts are required from management level. To change the existing offline process is not an easy task. People are always accustomed to familiar operation methods, and often have instinctive rejection of new things. This requires business leaders to have enough determination and skills to promote the popularization of new technologies through various efforts.

In this way, break-through technologies like AI can avoid being turned into empty talk and really landed to serve the transportation industry.