How is the transportation situation recovering after the outbreak of COVID-19?

Page views: 1,235 times

Page views: 1,235 times

Since the COVDI-19 broke out at the beginning of 2020 in China, the crisis has not yet been resolved. Many industries have been significantly affected and some enterprises even stop the business. As a chain reaction, the supply chain is undoubtedly under enormous pressure. Restoring normal operations as quickly as possible is now one of the most important tasks for supply chain managers.

To visualize the impact of the outbreak on the enterprise supply chain and the status of current operational recovery, we extracted the real-time data* from our oTMS platform and produced this transportation data report.

*Data Sample size: 100 plus shippers’ orders on oTMS platform; number of orders for the same period in 2019 is approximately 4-5 million orders per month

Order Quantity : The amount of assigned orders from shippers’ accounts (excluding orders imported to platform but not allocated)

B2C Order: E-commerce orders; delivered by courier

B2B Order: Offline channel orders; delivered by road transport

Analysis of the impact of COVID-19 on the logistics of shippers

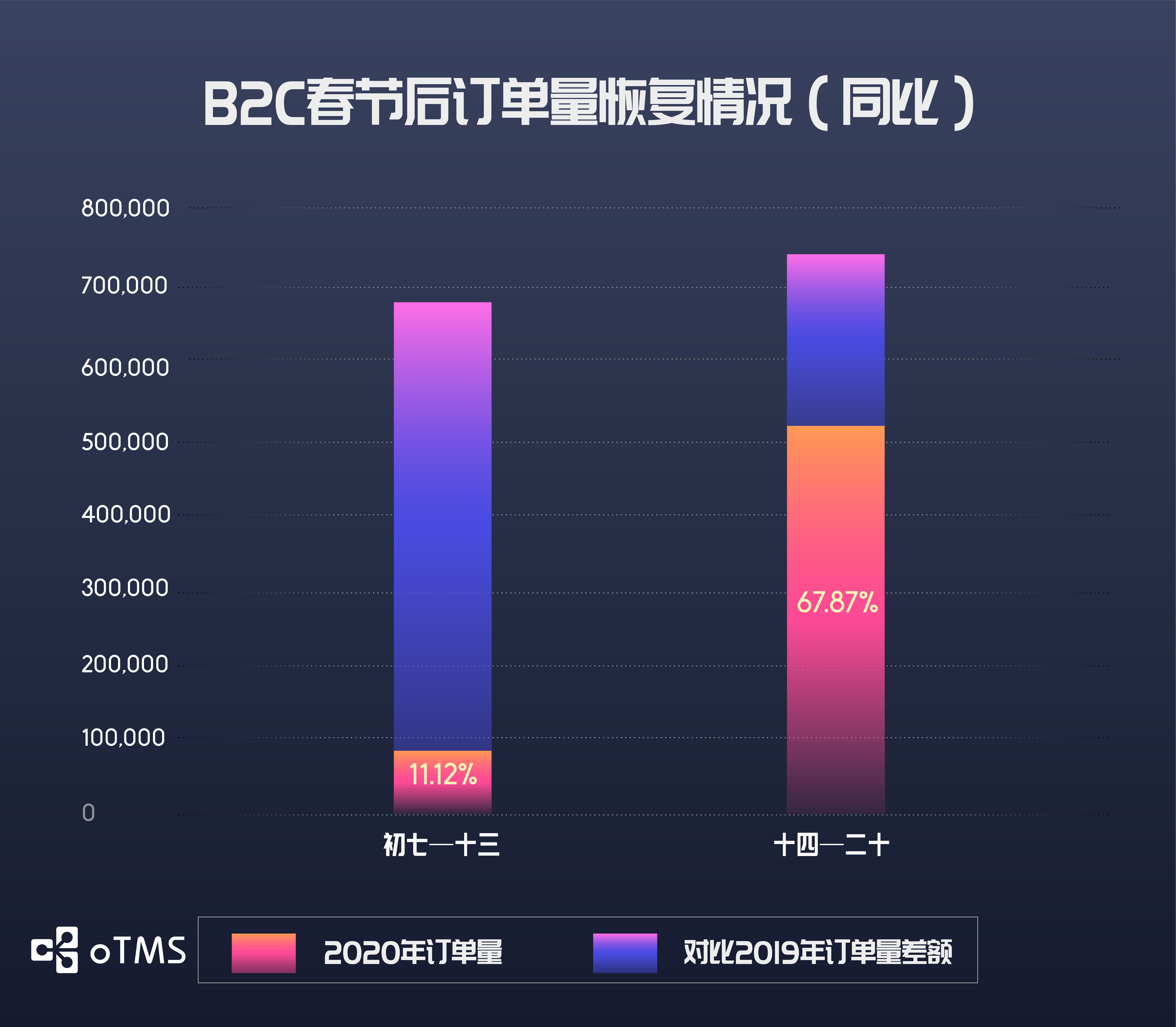

B2C order volume recovery after the Spring Festival (year-on-year)

Compared with the same period of the Spring Festival in 2019, due to the extended holidays and road closures caused by the epidemic, the express delivery volume of the week after the Spring Festival was only 11.12% of the same period last year. However, the overall recovery trend of express delivery is rapid. Only one week after, it has recovered to 67.87% of the same period last year.

B2B order volume recovery status after the Spring Festival (year-on-year)

On the other hand, the recovery of B2B road transportation orders is very bleak. Compared with the same period of 2019, the number of B2B orders in the week after the Spring Festival is only 9.88% of the same period last year, less than 100,000 orders. One week later, the volume was still reduced by nearly 90%.

Among them, the recovery of B2B transportation varies from industry to industry.

Order volume recovery status after the Spring Festival – fashion industry (year-on-year)

The fashion industry, because its offline stores are mainly located in shopping malls or commercial districts which mostly closed during this period, was affected the most in the epidemic. The order volume in the first week after the holiday fell sharply, even less than 1% in the same period last year. In the second week, it was only 2.25% last year, less than 10,000 orders.

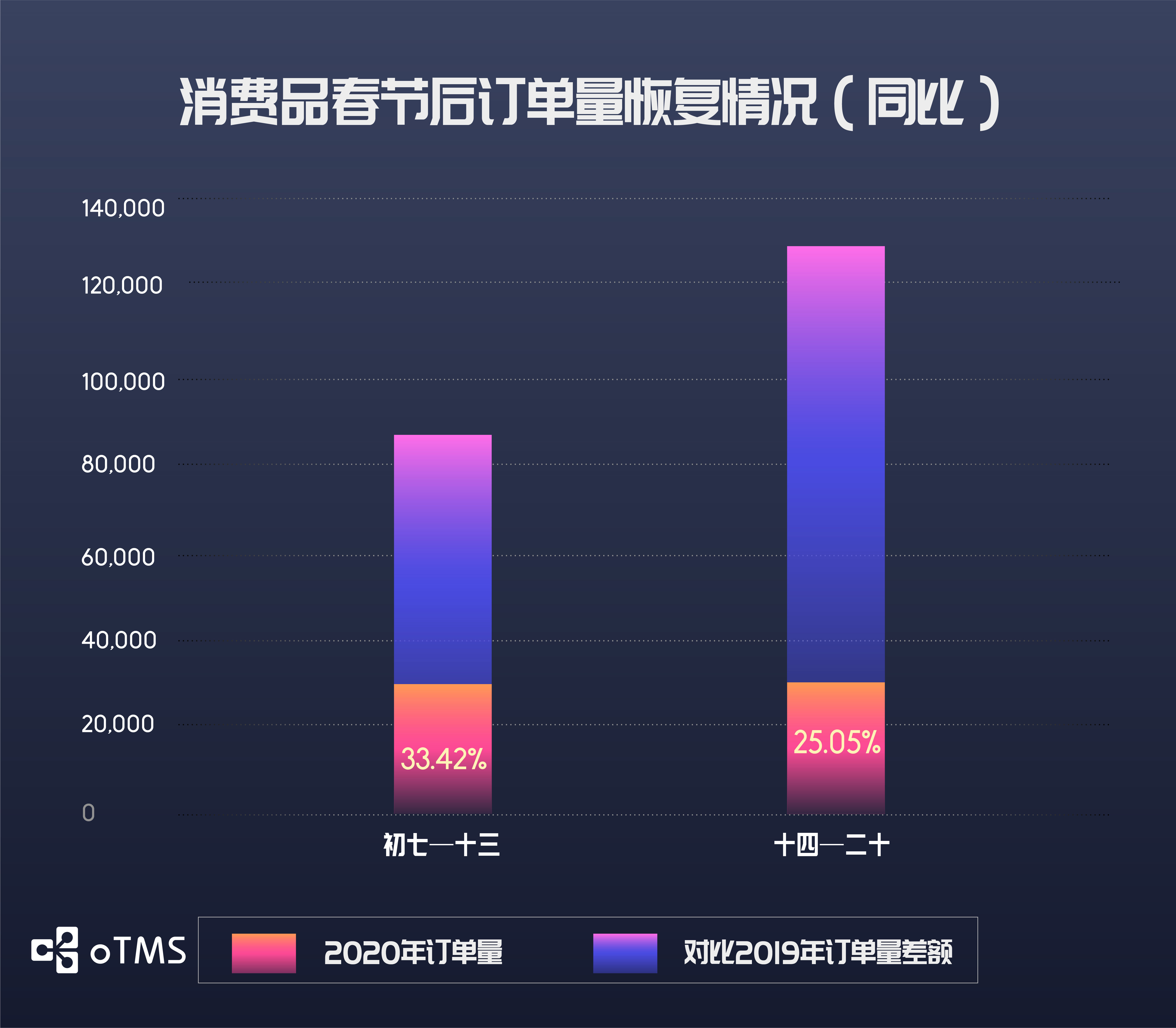

Order volume recovery status after the Spring Festival – consumer goods industry (year-on-year)

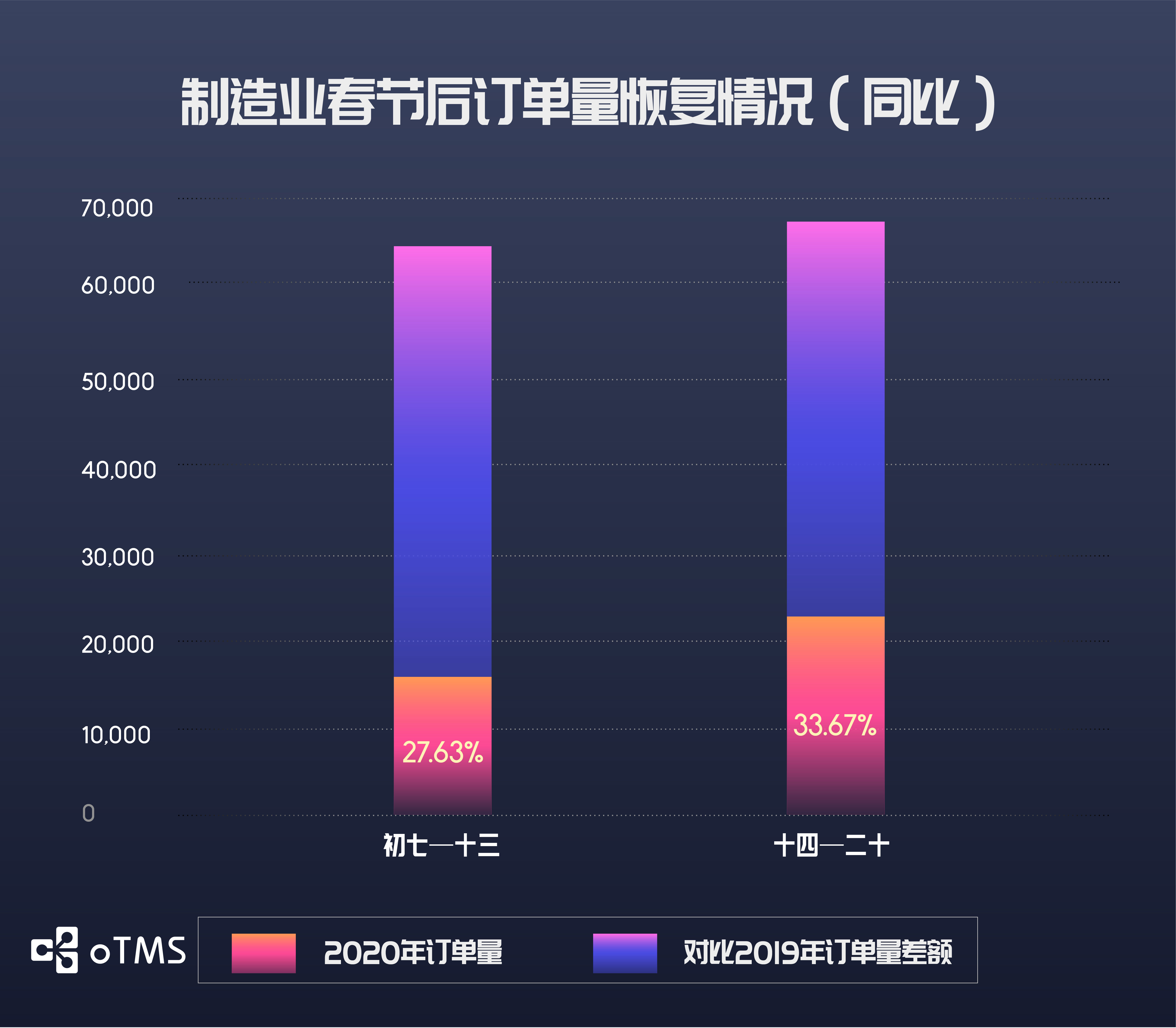

Order volume recovery status after the Spring Festival – manufacturing industry (year-on-year)

The consumer goods sector and the manufacturing sector also maintained a low of 25% to 35% orders volume over the same time last year. The current epidemic has undoubtedly brought a lot of pressure on the supply chain of the shippers

We don’t think the above data means the disappearance of transportation demand, but only that these demands have been restrained in the short term. For example, the consumer goods compainies and manufacturing factories actually have a large backlog of orders that need to be transported, but the transportation capacity has not been restored due to drivers’ failure to return to work and poor road traffic etc.. Limited capacity supply makes it difficult for shippers to restart working. Shoes and apparel fashion brands have a very low order recovery rate in offline channels, but we can see that a large number of fashion brands are expanding their online sales. It is believed that with the gradual control of the epidemic and the gradual recovery of production and consumption, the logistics industry will rebound significantly and complete the backlog of demand in the early stage. However, from the perspective of total volume, the total demand in 2020 will decrease with a high probability, but it will have different impacts on different industries.

The pace of logistics resumption is accelerating

With the government’s active promotion of the orderly resumption, we can see that both B2B and B2C order shipments are accelerating.

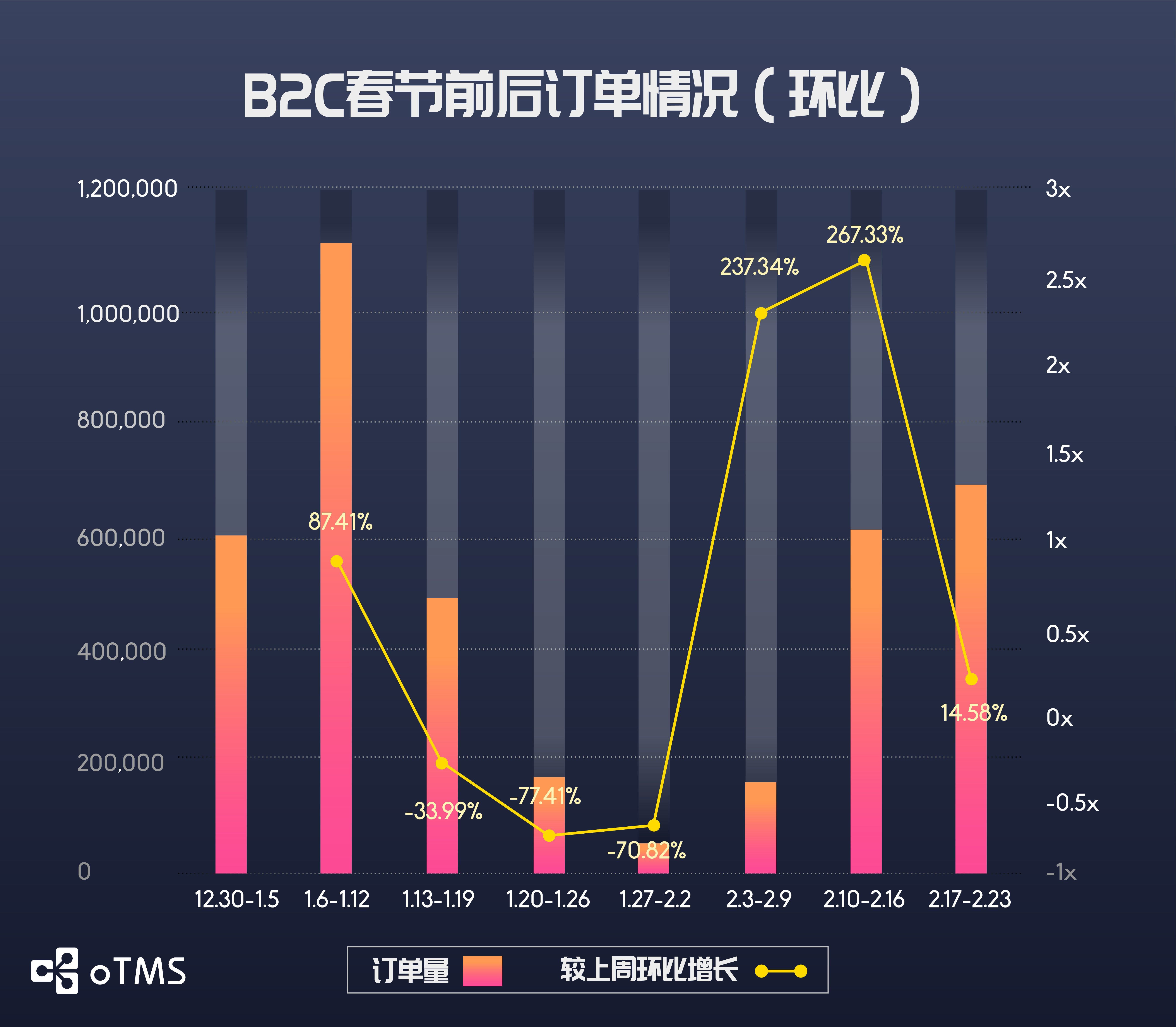

B2C order volume before and after the Spring Festival (week-on-week)

E-commerce order shipments rebounded rapidly after the holiday, especially in the two weeks from February 3 to February 16, which have increased by more than 200% compared to the previous cycle. At present, e-commerce order shipments have basically returned to pre-holiday levels. Weekly order volume recovered to 61.80% of the peak before the holiday.

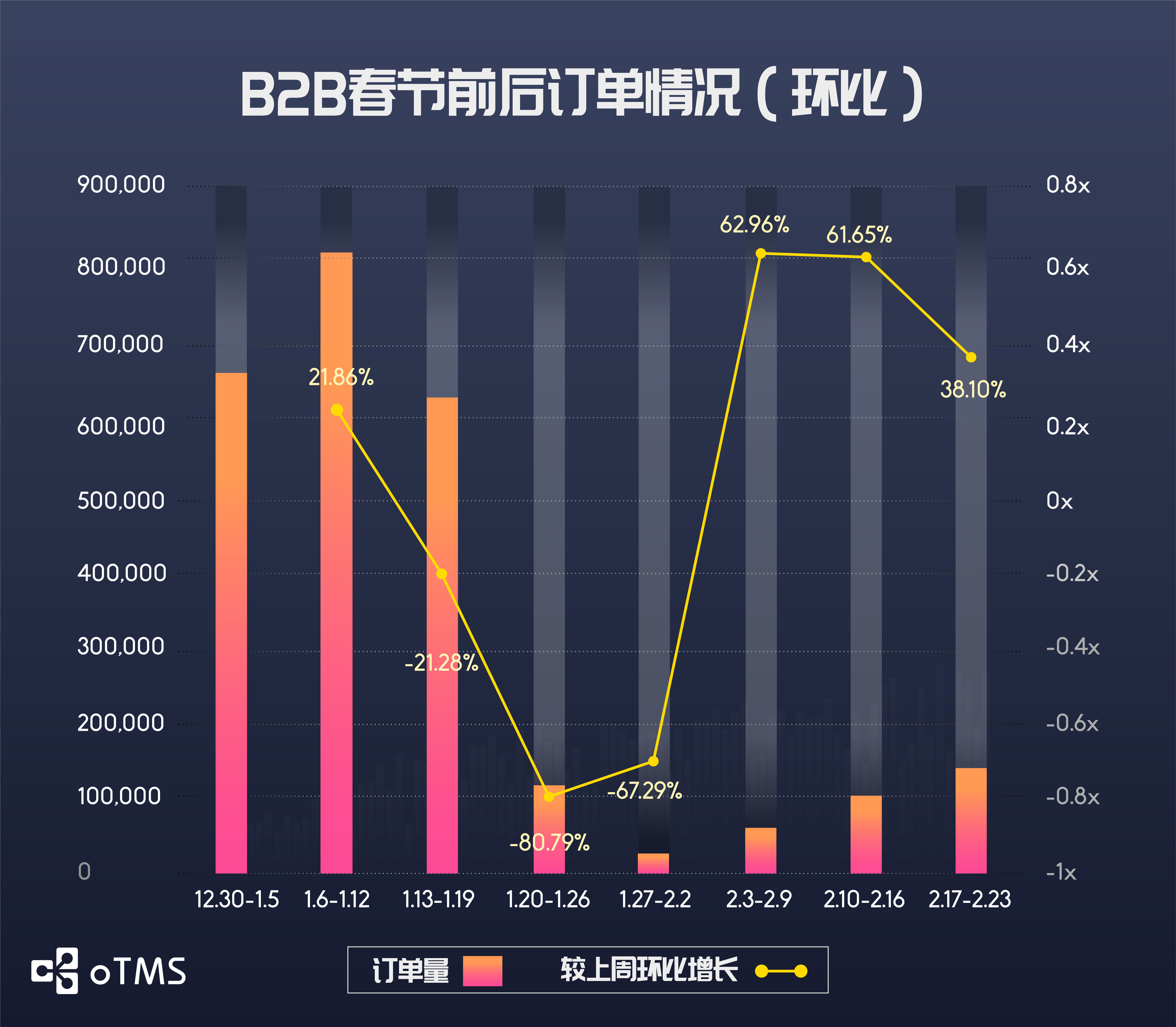

B2B order volume before and after the Spring Festival (week-on-week)

In contrast, the B2B order volume recovery is relatively slow. As of last week, the weekly order volume has only recovered to 17.99% of the pre-holiday peak, but the overall trend shows an upward trend.

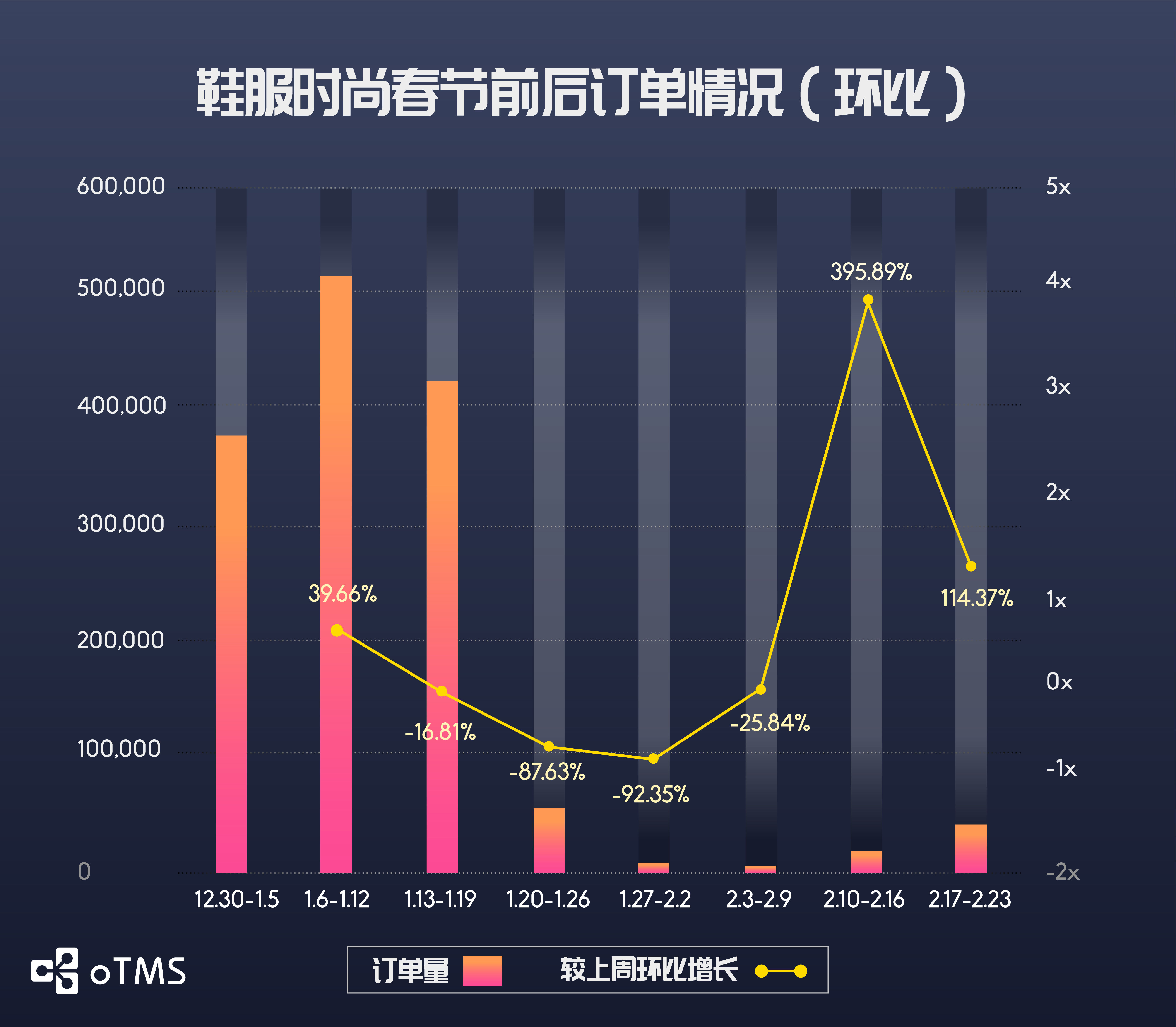

Order volume before and after the Spring Festival – fashion industry(week-on-week)

Among them, although the most affected fashion industry has seen an increase in order volume in the past two weeks of more than 100% week-on-week, as offline customer traffic cannot be recovered for the time being, the B2B shipments on February 3-9 were only 0.58% of the peak period before the holiday. Until February 23, weekly order volume also only recovered to 6.2% of the pre-holiday peak. It can be seen that the recovery of its total order may take a long time, and it depends on the development trend of the epidemic in the future.

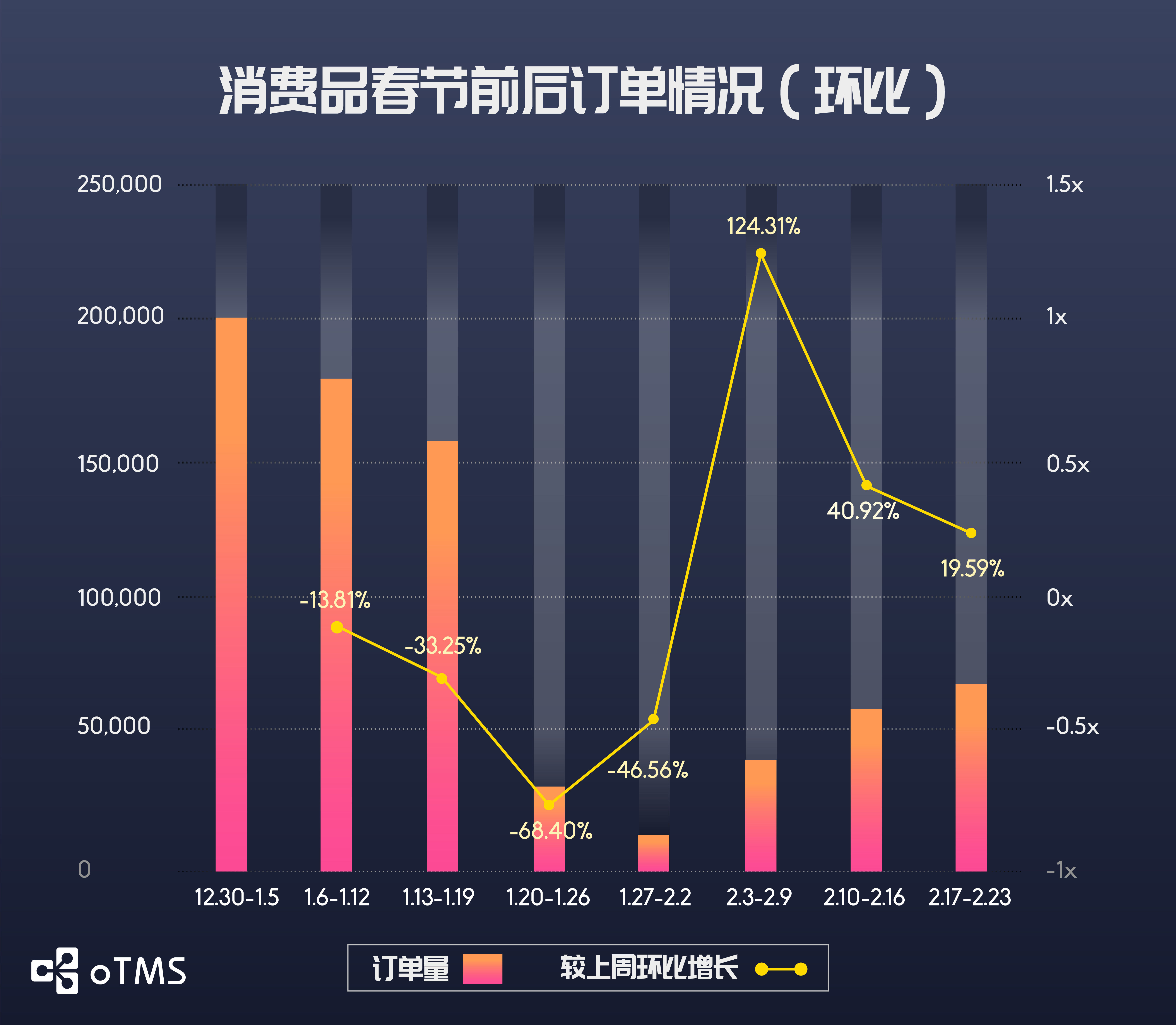

Order volume before and after the Spring Festival – consumer goods industry(week-on-week)

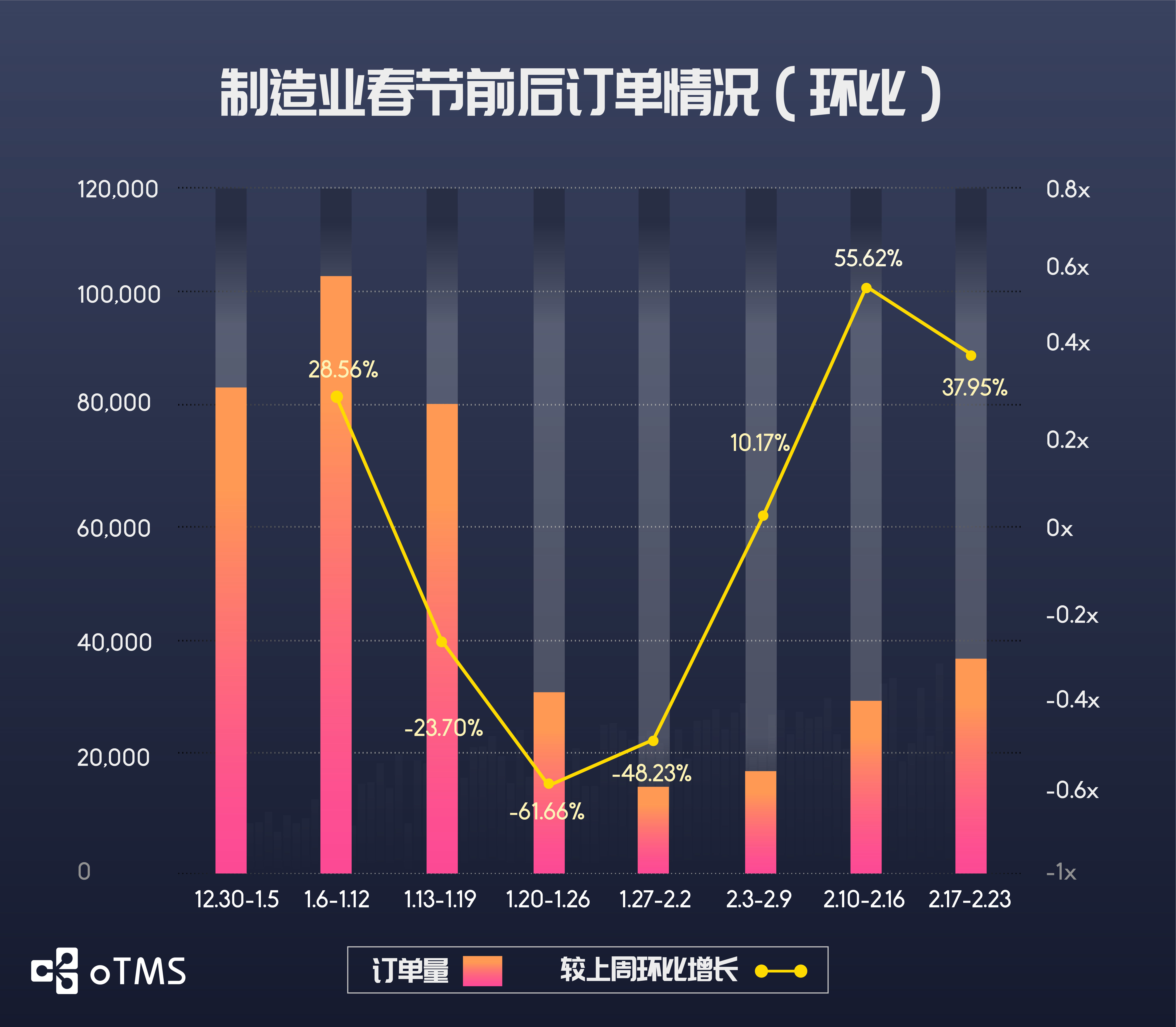

Order volume before and after the Spring Festival – manufacturing industry(week-on-week)

Shipment volums of the manufacturing and consumer goods industries showed a steady upward trend, with manufacturing orders returning to 35.82% of the peak before holiday and consumer goods to 36.72%.

Analysis of regional logistics resumption

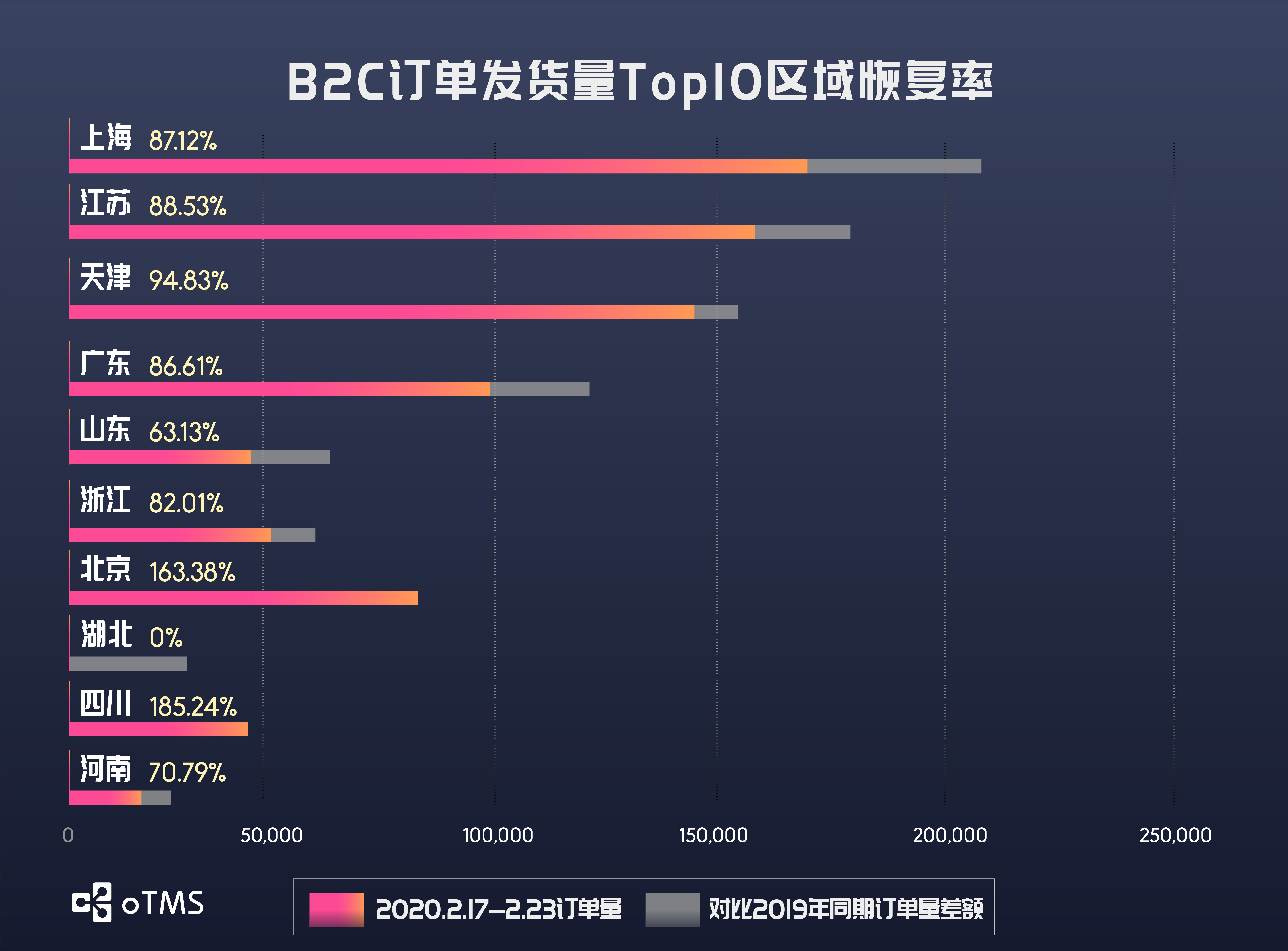

Recovery status of Top 10 regions for B2C order shipments

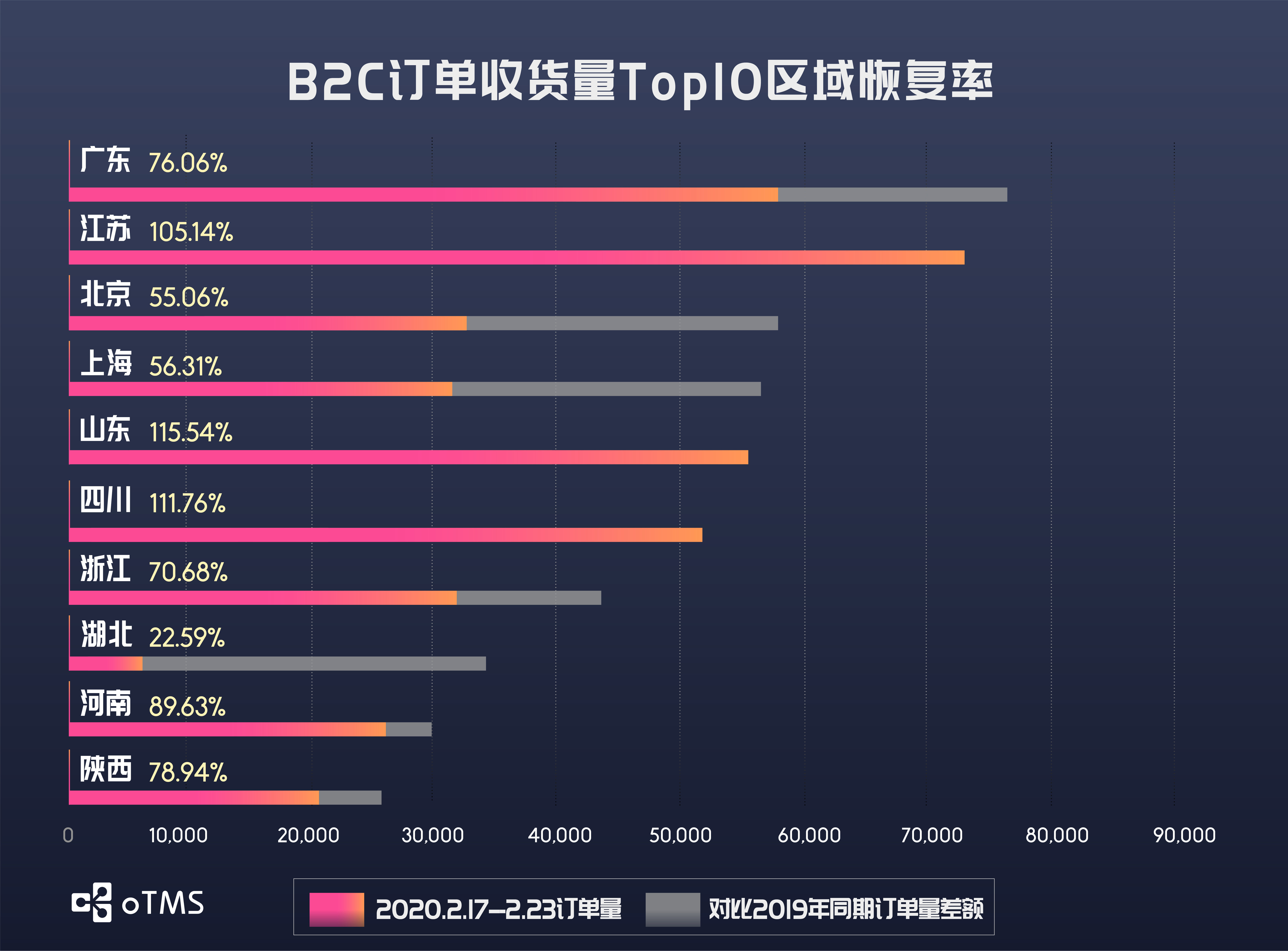

Recovery status of Top 10 regions for B2C order receipts

By observing the top ten regions in terms of receipts and shipments, we noticed that as of last week, except for Hubei Province due to regulatory reasons, the courier services in other major regions have been basically or fully restored. And because there are still some companies that have not resumed work, a large number of staff have not returned to their posts. The express delivery volume of cities with major entering populations including Beijing, Shanghai, Guangdong is still lower than in previous years.

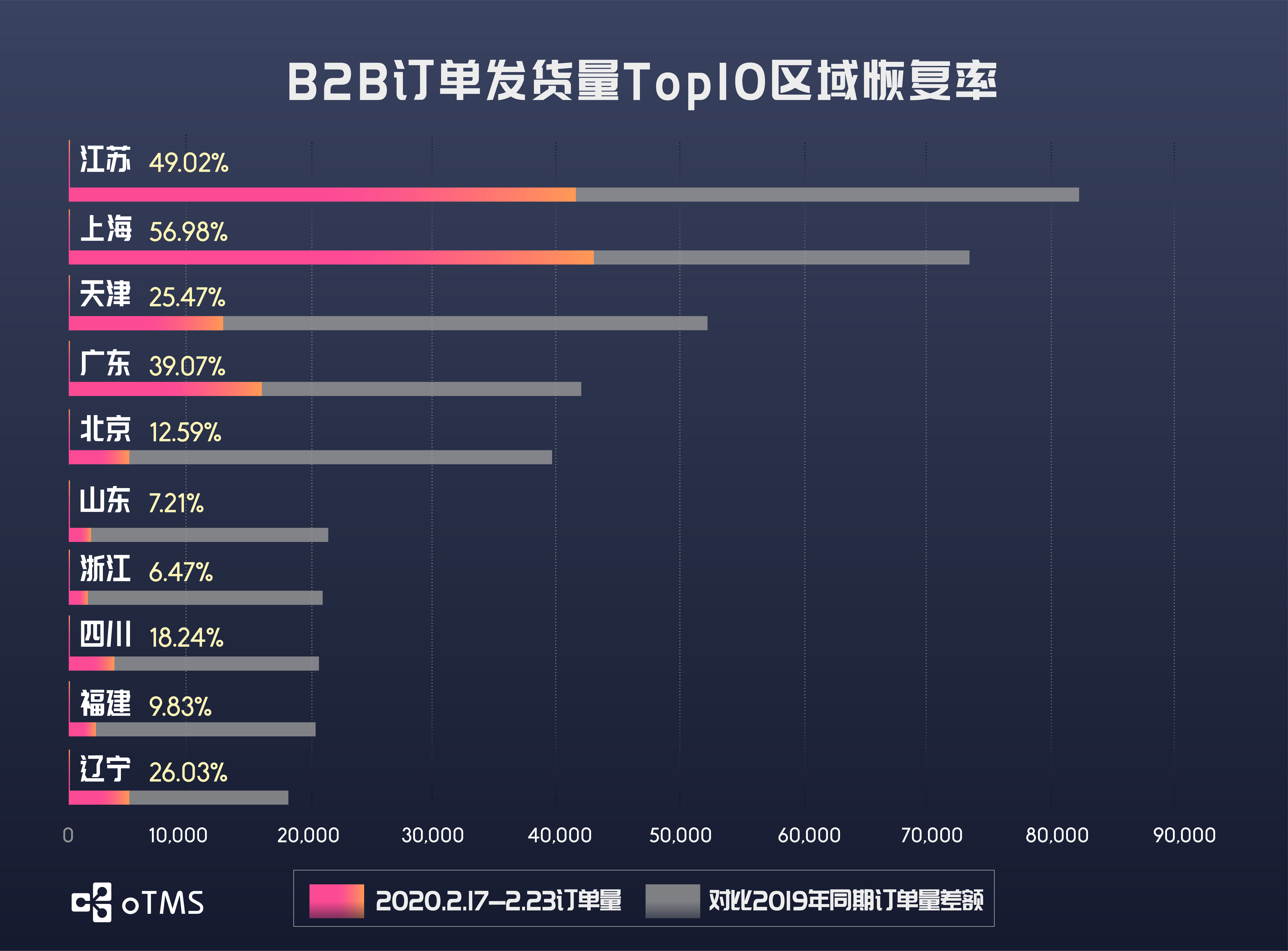

Recovery status of Top 10 regions for B2B order shipments

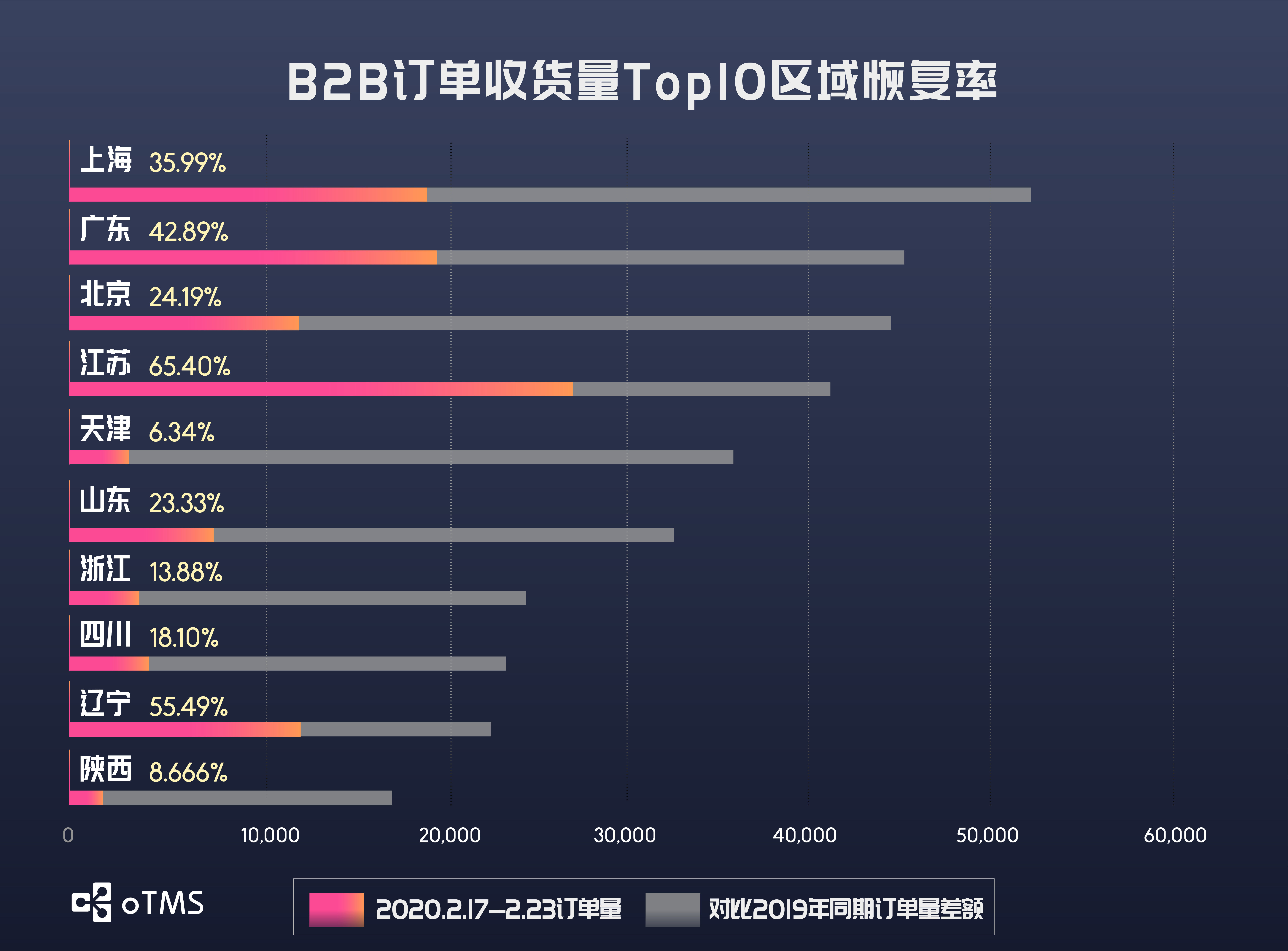

Recovery status of Top 10 regions for B2B order receipts

Among the top 10 regions in terms of B2B shipments, only Shanghai has a recovery rate of more than 50%. Beijing has a recovery rate of 12.59%, and Fujian, Shandong, and Zhejiang have recovery rates of less than 10%, of which Zhejiang is only 6.47%. In terms of receipts recovery rate, only Jiangsu and Liaoning exceeded 50%, Shanxi and Tianjin were less than 10%, and the lowest ranked Tianjin was only 6.34%.

It is believed that with the gradual control of the epidemic and the further promotion of return to work, the logistics recovery of shippers will accelerate and gradually return to normal. oTMS will also continue to launch weekly transportation recovery reports.

This outbreak of the epidemic caused the supply chain managers to think about how to build a smart supply chain that can respond quickly to cope with the increasingly complex operating environment. At the same time, as many companies’ Q1 revenues have fallen significantly, it is foreseeable that reducing costs will become the theme throughout 2020.

As the leading transportation management platform in China, oTMS has always been committed to helping enterprises optimize transportation management through technology and services. While realizing digitalization and visualization of transportation, oTMS also helps enterprises to reduce transportation costs sustainably and improve transportation service levels.