Running Fast or Standing Still?:5 Years Since The Launch, How Far is oTMS on It’s Path of Transforming B2B Deliveries in China?

Page views: 3,149 times

Page views: 3,149 timesby Jiling Zheng

In China, the average life cycle of startups is less than 3 years. oTMS and its oneTMS (oTMS SaaS Transport Management System) are welcoming its 5th year anniversary. As the company starting cloud/SaaS movement in Chinese transport industry, oTMS continuous to innovate. Its vision is to transform transport industry using technology, financing and operations data so both shippers and carriers can build more dynamic and competitive supply chain.

So after 5 years, how far are they on the journey to reach their visions? Any mistakes have been made? Is it even close to profitability? Will SaaS model be able to transform Chinese transport industry? Or will it be the China version of C.H. Robinson? We throw all these questions to Mirek Dabrowski, co-founder and CEO of oTMS, trying to figure out how domestic startup is doing on the way of revolutionizing this traditional industry.

Step Out the Comfort Zone; Transport Connected as the Only Way Out

Mirek’s Polish nationality is often viewed with suspicion. People challenge that a foreigner is not able to understand Chinese transport environment. However, Mirek had been working in top logistics companies for over 10 years in China back to 2010 when he decided to start this business. From Maersk to DHL to DSV, came here as a management trainee in 2000 and eventually served as VP & General Manager of China, he deeply felt the pain points within transport industry, such as high fragmentation & multi-level subcontracting, heavy manual operation, limited control over carriers, lack of transparency over shipment status and transport rates. He found that it’s impossible for him to execute meanigful change from within even biggest logistics companies, so he decided to come out and try a new and unique approach.

“I had this burning idea and strong belief that it can make a difference. I’ve been in China most of my professional career and I thought I could contribute my experience here instead of leaving nothing behind. I would shoot myself if I don’t do anything and years later someone else accomplish my idea.” He said.

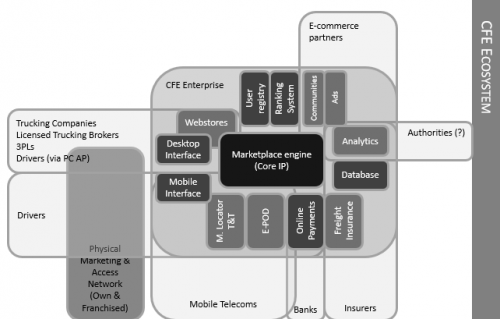

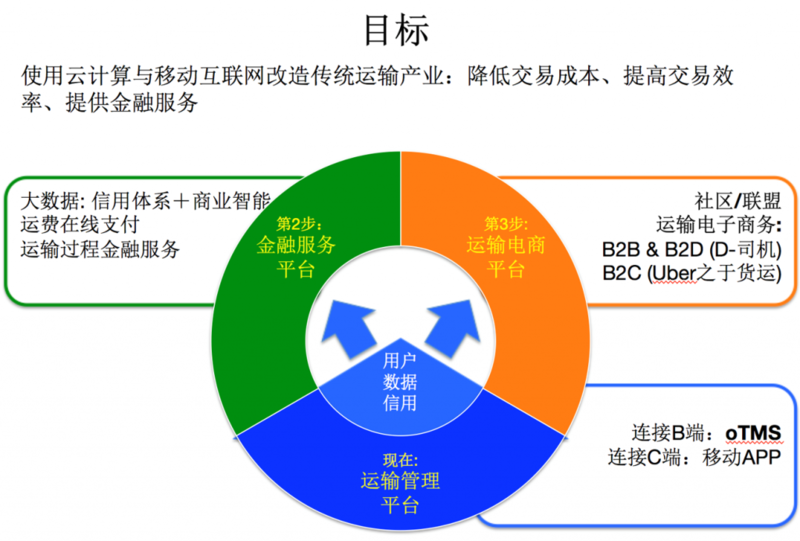

In fact, oTMS is not the original idea, back to 2010, Mirek had an idea called CFE (China Freight Exchange) to provide online marketplace for transport transactions. The marketplace requires large scale of users and high-quality data to make transaction happen online which was important goal of CFE. Data should be acquired in automatic way but back then the adoption of TMS in China was very low. Mirek then came up with the conclusion with David Duan (co-founder and President of oTMS) that they should build a simple TMS as a starting point to get users & data and then use it as launching pad for the marketplace later.

Traditional enterprise software in the past is internal, four-wall system, unable to get data from the entire transport chain. Only SaaS which is based on public cloud can do the seamless, real-time exchange of information flow. As a result, oneTMS Transportation Management Cloud System was officially launched in 2013.

When shipments are executed on oneTMS platform they digitize business connections and generate clean “big data, a single version of the truth shared among all transaction participants – the complete loop starting from shipper (retailer/manufacturer) through logistics provider, carriers down to drivers and consignees. This is essence of “Transport Connected” and a must for effective procurement and financing products.

SaaS Could is Made for Transportation

oneTMS expand its market share and gained more than 1,500 shippers and carriers within five years. It’s oTMS who built up and nurtured domestic SaaS TMS market. With USD 40m venture capital injection, oTMS got fame but at the same time, it attracted the attention of traditional software companies as well as lots of imitators. These are the problems that every entrepreneur will face. Challenging the traditional mode inevitably will meet resistance and interests inevitably leads to followers joining the battlefield.

“I’m a vision driven person, so I only focus on building right products that can attract right customers and make them successful so our ecosystem gets bigger and we are getting closer to our vision. I personally don’t really care about competitors. Of course, many of our features got copied. We can take it as compliment – validation we do the right thing and incentive to improve the product as we continue to do on a monthly releases since 2013, one of the key benefits of SaaS.”

In his view, the key question from customers’ point of view should be: “what is behind all these software features – what do you really want to achieve by implementing TMS? ”

“Is your TMS vendor just a traditional software company, willing to do any customization and absorb any customer requirements to maximize their revenue? I’ve learnt that buying enterprise software is like buying a semi-assembled car. You get chasis and engine but it is up to customer to design and co-assemble all the rest and pay for that too. For tranditional software company without any platform vision it’s an easy revenue model.

“Owning the software and depreciting it over time is one of biggest myths that people take for granted. It’s a great invention of US sales and marketing machine of 1980’s. The “ownership”reality is you pay both upfront for “license” and then 15-20% of this amount annually for“maintenance”while the irony is that you have to host software yourself; you depreciate it for 5 years but resell value is ZERO from day 1.f To truly own the software you need to develop it yourself and have control over source code – this is very expensive and can make sense for very few companies. ”

Comparing the traditional software and SaaS, Mirek comments, “SaaS is very immature in China, though in US and Europe, everyone is switching to public cloud. In China, while it is getting better we still face very traditional software buying model. This process takes time. However, SaaS model is the only future and the only way to connect the transport. Why?”

“Transport Execution itself is an external process, so if you want real online data, cloud is the only solution. There is no other way around. Planning and optimization can reside on-premises since it is within 4-walls process. Our system provides APIs to such systems and some ready pre-integrations with GPS vendors like G7 and routing optimization like Geoconcept. ”

oTMS SaaS value proposition is always directly into business benefits. The chief difference that sets oTMS totally apart from other vendors is the Transport Connected platform vision. They strive to minimize implementation time and cost and fully leverage SaaS concept to deliver business results fastest.

Moving Forward: Technology Alone Cannot Make a Difference

Starting from the beginning, procurement and payment are always included in oTMS business plan, because technology is only the foundation.

“Initially I thought that once you give people the tools they will figure out how to use them.” – in other words, oTMS initially intended to be pure “platform”linking users to transact directly and provide them just online procurement, execution and pay tools to make end-to-end transactions. Reality is not that simple, especially in complex enterprise to enterprise scenario.

“We noticed that oTMS system showed different results when used by different customers. Technology alone cannot completely revolutionize the industry, because even we always have client’s senior management endorsement, sometimes in the implementation and execution some key elements are “lost in translation”. Change management is complex and it plays differently in different organizational cultures, there are no simple rules. Sometimes enforcing new process meets resistance or lack of understanding from certain stakeholders. I realized that it is always that people make a difference, and technology is the key enabler of this change.”

Mirek also admits freely that “people” includes oTMS own sales, implementation and product management staff – it takes time to recruit, train and develop these capabilities in a brand new market. “Sure, we have projects that we should have executed much better.” he said. In 2017, oTMS has 30-40 new clients under implementation at any time , such pace of growth is obviously challenging to manage.

“In past 2 years we launched some collaborative transport products like oSuper – mall-2-mall retail store delivery, return, transfer and o2o shipment solution where customers clearly expressed demand for oTMS to take a more central role as a platform – such as for example, add platform contract, invoice and insurance standards.” Also many new shippers started to ask for carrier recommendations when joining oTMS network – often asking same time if oTMS would facilitate negotiations and guarantee performance.

While originally reluctant to such voices, this year, Mirek went to the US for a several weeks tour meeting many new and established technology companies in transport space including very successful companies such as Transplace and C.H. Robinson that are often used as reference in China. The trip convinced him that outsourcing with technology as core was the right and proven move. “US market is most competitive, most advanced domestic transport market, but it is so misunderstood in China. You can’t simply copy to China these ideas, it is also one reason why global TMSes generally fail here. But you can certainly learn a lot.”

“In the past few years, we are mainly focusing on SaaS and everyone was given the impression that we are a SaaS company which is not our initial idea. In retrospective, I need to admit to myself a failure to push harder and sooner to add procurement and financing pillars, instead of simply building largest SaaS client base. Sometimes we went outside developing core features needed for our vision and instead we tried to satisfy all kind of client reqirements that some traditional systems should be able to do better.

oTMS was born as a platform, not a software company. The launch of Orange is moving forward towards our vision by going back to where Mirek and David started and the vision that attracted all early employees and investors.”

oTMS Orange was launched this month, which integrates key products into one easy-to-use service for shippers. It’s an end to end platform service including procurement, execution, pay and data analysis, backed by oneTMS leading technology and oTMS professional experts. Orange service further helps customers to reduce transport costs and extract real-time operations data to offer better experiences. It is simply achieved by using oTMS technology , direct carrier network on oTMS and even other shippers where co-loading or co-procurement is possible, such as oSuper and hypermarket deliveries for FMCG.

This model is similar with Transplace and C.H. Robinson, except that they do service first and technology later. oTMS started from oneTMS technology and then push the service.

“Orange is a new concept in Chinese market but the demand is much stronger and deals happen much faster than usual TMS project. People may think that we are becoming traditional third-party logistics company because we are now doing transport executions. It’s just like the appearance of Uber and Didi, which arouse lots of questions at the beginning. It’s ture that there are similarities between 3PL and us. Our goal is the same which is delivering the goods for shippers but in a very different way. We are more like Didi platform and 3PL are like taxi companies. 3PLs are not our competitors. We have 3PLs as our customers, who can still use oTMS solution and system to manage their transport and to source carriers. It’s like you call taxi through Didi platform.”

oneTMS and Orange are just two different ways of delivering the technology. oneTMS as SaaS is designed for self-use of customer who has both budget and own team to procure and manage carriers. Orange is to simply leave these activities to oTMS as a platform – no upfront budget is necessary, technology and other fees are paid directly from transport cost and savings that oTMS commits are achieved upfront. “We see many customers prefer such solution as much faster way forward, and also a way to incetivize their incumbent carriers to adopt oTMS better and improve service levels via other means.”

“When we started with David in 2011, we knew we have exciting and long journey ahead, I am looking increasingly optimistic at the future, the changes we instigated in China and the mindsets that are changing here fast.”

Finally Show Profitability in the Coming Year

With 2018 around the corner, it’s good time to ask Mirek for plans for next year:

“2017 we estimate to reach approx. 60m shipments on the platform and continued to add major customers in several key industries, not just oneTMS but also Orange and Fintech solutions. In order to achieve this we went through some significant adjustments internally and in a 5 year old company this is not easy to execute and involved some painful tradeoffs. Both ours and our investor expectations are that oTMS shows profitability in 2018 and we made it possible to reach this target.”

When asked about specific products innovation to be expected from oTMS, Mirek says that the technology development will be more focused. There will be just 4 major releases per year, as many other mature SaaS platforms like Salesforce. “This will let us deliver a better quality and more comprehensive upgrades, more suitable release cycle for company of our size and often also for customers who need time to absorb new features”oTMS APIs and our user interface is up for a major refresh to make oneTMS more of a true SaaS platform with high degree on configurability.

“I am personally most excited about integrating payment/financing into oTMS process where we expect to enable early payment not just on invoice like traditional factoring product but also partial payment to carriers on delivery (ePOD). This is solving one of major pain points of this industry and providing stronger incentive for carriers to participate in our platform and adopt daily oTMS process better.” Faster payment will be enabled by external funding platforms like banks and factoring companies at much lower cost given oTMS data quality and shipper participation. It is particularly promising area given that we estimate transport spend executed on oTMS is close to 10 billion RMB in 2017. Ultimately oTMS plans to use payment and blockchain technology to secure the trust, execution discipline and low transaction cost on oTMS platform.

Another key area is dynamic procurement. Mirek shared: “we are now experimenting with some customers adopting some overseas models to make this process much easier, faster and flexible then ever thought possible in China.

Early January we have major upgrade of FreightPartner transport bidding marketplace portal that already attracted over 2200 companies since August launch. The focus is to match shipper specific requirements with most suitable carriers by using data and algorithms – so actual bidding/negotiation can be faster and more effective than traditional offline process or other “yellow pages-like internet sourcing portals. In 2017 we processed slightly under 1 billion RMB in transport procurement bids already. FreightPartner is accessible by anyone directly on the internet and you can register for a free account here. ”

“We always look for customers who share our vision, who are open to co-innovation: sharing own ideas, adopting other’s best practices and taking the view that collaboration with their transport partners creates easier and more sustainable improvements”

“I’m grateful to our customers, colleagues and investors that backed us who believe that with together this innovations can make a difference.

If you want to learn more about industry developments in 2018 you can subscribe to our Wechat account (oTMS一站式运输服务平台) or you can contact David Duan or Mirek Dabrowski directly here if you want to get in touch with us.”